What Is Small Business Insurance?

It’s type of commercial coverage designed to protect small businesses from various risks and liabilities. It can include several policies such as general liability, commercial property, business auto, workers’ compensation and others.

Commercial insurance policies cover damages like legal fees, property damage, employee injuries, and accidents. Customizable to a business’s specific needs, this insurance is vital for financial protection and compliance with legal requirements. It helps small business owners safeguard against unforeseen costs that could otherwise jeopardize their operations.

Top Small Commercial Insurance Policies

General Liability Insurance

General liability insurance provides protection for businesses against financial losses due to third-party claims of bodily injury, property damage, and personal and advertising injury.

Commercial Property Insurance

Commercial property insurance is a type of coverage that protects businesses against losses due to damage to their physical assets, such as buildings, equipment, and inventory.

Workers Compensation

Workers’ compensation insurance is a policy that provides medical benefits and wage replacement to employees injured during employment.

Business Owners Policy

A Business Owners Insurance Policy (BOP) packages several types of coverage, such as commercial property, general liability, and business income insurance.

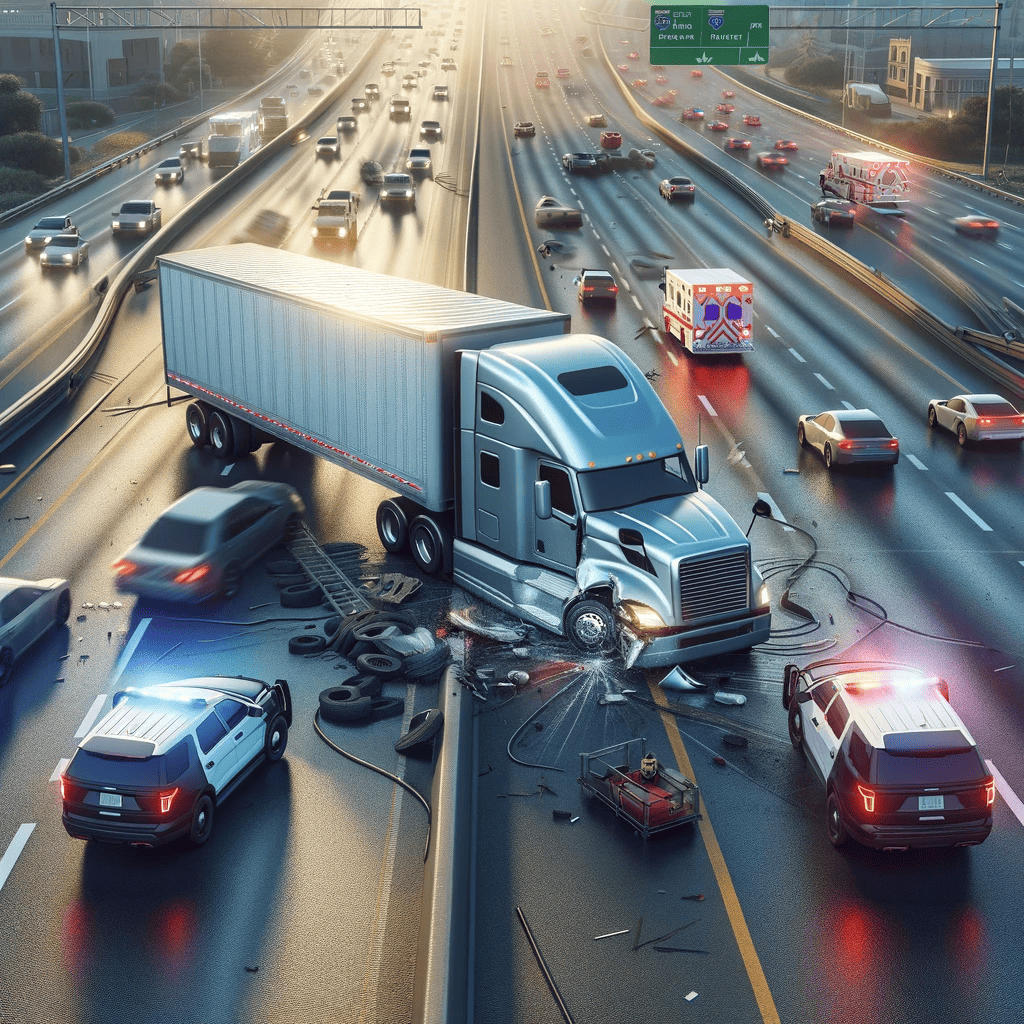

Commercial Auto Insurance

Commercial auto insurance provides coverage for vehicles used for business purposes like cars, vans and trucks, protecting against liability and property damage in the event of an accident.

Professional Liability Insurance

Professional liability insurance (aka E&O) provides protection for businesses and professionals against claims of errors, omissions and negligence in the services they provide.

Learn More About Commercial Insurance

Learning more about commercial insurance is an essential step for any entrepreneur or business owner. Insurance not only safeguards your business against various risks and unforeseen events but also provides peace of mind, allowing you to focus on growing your enterprise.

Understanding the different types of insurance available, from general liability and professional liability to property and workers’ compensation, is crucial. Each type caters to specific aspects of business risk and legal requirements. Additionally, the costs and coverage details can vary significantly based on your industry, business size, and specific needs.

Choose the Best Types of Business Insurance

Common Business Insurance Questions

Why do I need small business insurance?

Business insurance is crucial for protection against unforeseen financial losses due to lawsuits, natural disasters, theft, and accidents, ensuring business continuity and financial stability.

How much does business insurance cost?

The cost varies depending on factors like business size, location, industry, and the amount of coverage needed. Generally, small businesses might pay anywhere from a few hundred to a few thousand dollars per year.

How do I choose the right commercial insurance?

Assess your business risks, consult with an insurance agent or broker, and consider industry-specific risks to choose the right coverage.

Do I need insurance if I'm a sole proprietor?

Yes, even sole proprietors face risks and can benefit from insurance, such as liability and property insurance.

What types of commercial insurance are there?

Common types include general liability insurance, professional liability insurance, property insurance, workers’ compensation, and business interruption insurance.

Is commercial insurance required by law?

Certain types, like workers’ compensation and unemployment insurance, are legally required in most states, but requirements can vary.

Can I get business insurance if I work from home?

Yes, home-based businesses often need insurance to cover business-related risks that aren’t covered by homeowner’s insurance.

How often should I review my business insurance needs?

Annually, or more frequently if there are significant changes in your business operations, size, or assets.