Professional Liability Insurance

Professional liability insurance, also known as errors and omissions insurance, is a type of coverage that protects professionals from financial losses resulting from claims of negligence, errors, or omissions in their professional services.

This insurance is essential for professionals who provide advice, expertise, or services to clients, as it safeguards them against potential lawsuits and claims that could arise from dissatisfied clients.

Having professional liability insurance is crucial for professionals as it provides them with financial protection and peace of mind. In today’s litigious society, even the most skilled and experienced professionals can face allegations of negligence or errors in their work.

Without the proper insurance coverage, professionals may be forced to pay for legal fees, settlements, or judgments out of their own pockets, which can be financially devastating. Professional liability insurance acts as a safety net, ensuring that professionals are protected from the financial consequences of claims made against them.

Key Takeaways

- Professional liability insurance is important for businesses and professionals to protect against claims of negligence or errors.

- Different types of professional liability insurance coverage exist, including errors and omissions insurance and malpractice insurance.

- Premiums can be affected by factors such as industry, claims history, and coverage limits.

- Choosing the right policy involves considering factors such as coverage limits, deductibles, and exclusions.

- Filing a claim involves notifying the insurer, providing documentation, and cooperating with the claims process.

Who Needs Professional Liability Insurance?

A wide range of professionals can benefit from having errors and omissions insurance. Any individual or business that provides professional services or advice should seriously consider obtaining this coverage. Professions that commonly require professional liability insurance include doctors, lawyers, architects, engineers, consultants, accountants, real estate agents, and IT professionals.

For example, doctors and healthcare providers need malpractice insurance to protect themselves against claims of medical negligence or errors in patient care. Lawyers require this coverage to cover legal malpractice claims that may arise from mistakes made during legal representation. Architects and engineers need this coverage to protect themselves from claims related to design errors or construction defects.

Types of Professional Liability Insurance Coverage

Malpractice Insurance

1. Errors and Omissions: This type of coverage is designed to protect professionals who provide advice or services against claims of negligence or mistakes in their work. It is commonly used by consultants, accountants, real estate agents, and IT professionals.

2. Malpractice: Malpractice insurance is specific to professionals in the healthcare industry, such as doctors, nurses, dentists, and therapists. It covers claims of medical negligence, errors in diagnosis or treatment, and other professional mistakes that may harm patients.

3. Directors and Officers: This coverage is essential for executives and board members of companies. It protects them from claims of mismanagement, breach of fiduciary duty, or other wrongful acts committed in their roles as directors or officers.

Understanding the Claims Process for E&O Insurance

| Metrics | Description |

|---|---|

| Claim Frequency | The number of claims filed per policy period. |

| Claim Severity | The average cost of a claim. |

| Claim Closure Rate | The percentage of claims that are closed within a certain timeframe. |

| Claim Denial Rate | The percentage of claims that are denied. |

| Claim Investigation Time | The average time it takes to investigate a claim. |

| Claim Litigation Rate | The percentage of claims that result in litigation. |

| Claim Settlement Time | The average time it takes to settle a claim. |

| Claim Loss Ratio | The ratio of claims paid out to premiums earned. |

When a claim is filed against a professional with professional liability insurance, there are several steps involved in the claims process. First, the insured must notify their insurance provider about the claim as soon as possible. The insurance company will then assign a claims adjuster to investigate the claim and gather relevant information.

The claims adjuster will review the policy coverage and determine if the claim falls within the scope of the policy. They will also assess the damages or losses claimed by the plaintiff and evaluate the potential liability of the insured. The adjuster may request additional documentation or evidence to support the claim.

Once the investigation is complete, the insurance company will either accept or deny the claim. If accepted, they will work with the insured to negotiate a settlement or defend against the claim in court. If denied, the insured may have the option to appeal or seek legal advice to challenge the denial.

Common Misconceptions

- Myth: Only large businesses need professional liability.

Fact: It’s not limited to large businesses. Even small businesses and self-employed professionals can benefit from this coverage. Claims can arise regardless of business size, and having insurance protection is essential for all professionals. - Myth: General liability insurance covers professional liability claims.

Fact: General liability insurance typically covers bodily injury, property damage, and advertising injury claims. It does not provide coverage for professional errors or negligence. Professionals need specific insurance to protect against claims related to their professional services. - Myth: E&O insurance is too expensive.

Fact: The cost varies depending on factors such as profession, coverage limits, claims history, and industry risks. While premiums may be higher for certain high-risk professions, the cost of insurance is often much lower than the potential financial losses that could result from a claim.

Factors That Affect Premiums

Several factors can influence the premiums:

- Industry and Profession: Professions with higher risks of claims or lawsuits may have higher premiums. For example, doctors and lawyers typically have higher premiums due to the nature of their work.

- Claims History: Insurance companies consider the claims history of the insured when determining premiums. Professionals with a history of claims may face higher premiums or difficulty obtaining coverage.

- Coverage Limits: Higher coverage limits generally result in higher premiums. Professionals should carefully assess their coverage needs to determine the appropriate limits for their specific risks.

How to Choose the Right Professional Liability Insurance Policy

When selecting a policy, professionals should consider the following:

- Assessing Risks and Coverage Needs: Professionals should evaluate the specific risks associated with their profession and determine the appropriate coverage needed to protect against those risks.

- Comparing Policies and Premiums: It is essential to compare policies from different insurance providers to ensure adequate coverage at a competitive price. Professionals should carefully review policy terms, conditions, and exclusions before making a decision.

- Working with a Reputable Insurance Provider: Choosing a reputable insurance provider is crucial to ensure reliable coverage and efficient claims handling. Professionals should research the financial stability and reputation of the insurance company before purchasing a policy.

Benefits of Having Errors & Omissions Insurance

Having professional liability insurance offers several benefits for professionals and businesses:

- Protection against Financial Losses: Professional liability insurance provides financial protection by covering legal fees, settlements, or judgments resulting from claims or lawsuits. This protection can help professionals avoid significant financial losses that could otherwise jeopardize their business or personal assets.

- Peace of Mind for Professionals and Businesses: Knowing that they are protected by insurance can give professionals peace of mind, allowing them to focus on their work without constant worry about potential claims or lawsuits.

- Enhanced Credibility and Reputation: Having professional liability insurance demonstrates a commitment to professionalism and accountability. It can enhance the credibility and reputation of professionals and businesses, giving clients confidence in their services.

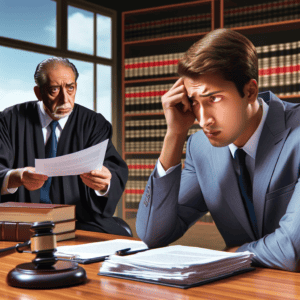

Risks of Not Having

Consultant Being Sued For Negligence

Not having professional liability insurance exposes professionals and businesses to various risks:

- Financial Losses from Lawsuits and Claims: Without insurance coverage, professionals may be personally responsible for legal fees, settlements, or judgments resulting from claims or lawsuits. These costs can be substantial and potentially bankrupt a professional or business.

- Damage to Professional Reputation and Credibility: A claim or lawsuit can damage a professional’s reputation and credibility, leading to a loss of clients and business opportunities. Insurance coverage helps protect against reputational damage by providing resources for legal defense and settlement negotiations.

- Legal and Regulatory Penalties: In some professions, not having professional liability insurance may violate legal or regulatory requirements. Failure to comply with these requirements can result in fines, license suspension, or other penalties.

How to File a Claim

When faced with a claim, professionals should follow these steps to file a claim for professional liability insurance:

- Notify the Insurance Provider: Contact the insurance provider as soon as possible to report the claim. Provide all relevant details, including the date of the incident, the parties involved, and any supporting documentation.

- Cooperate with the Claims Adjuster: Work closely with the assigned claims adjuster, providing any requested information or documentation promptly. Cooperating fully with the investigation will help expedite the claims process.

- Seek Legal Advice if Necessary: If the claim escalates or becomes complex, professionals may need to seek legal advice to protect their interests. An attorney experienced in professional liability claims can provide guidance and representation throughout the process.

Professional Liability Insurance FAQs

What is professional liability insurance?

It’s a type of insurance that protects professionals from claims of negligence or failure to perform their professional duties.

Who needs professional liability?

Professionals who provide advice or services to clients, such as doctors, lawyers, accountants, architects, and consultants, should consider getting professional liability insurance.

What does E&O insurance cover?

Professional liability insurance covers claims of negligence, errors, or omissions in the performance of professional duties. It can also cover legal defense costs and settlements or judgments against the insured.

What is the difference between professional liability and general liability insurance?

General liability insurance covers bodily injury, property damage, and personal injury claims, while professional liability insurance covers claims of negligence or failure to perform professional duties. General liability insurance is typically required for all businesses, while professional liability insurance is only necessary for certain professions.

How much does professional liability insurance cost?

The cost of professional liability insurance varies depending on the profession, the level of risk, and the amount of coverage needed. It can range from a few hundred dollars to several thousand dollars per year.

How do I choose a policy?

When choosing a professional liability insurance policy, consider the level of coverage needed, the cost of the policy, the reputation of the insurance company, and any exclusions or limitations in the policy. It is also important to compare policies from different insurance companies to find the best coverage at the best price.

Importance of E&O for Businesses and Professionals

In conclusion, professional liability insurance is a crucial safeguard for professionals and businesses that provide services or advice to clients. It protects against financial losses resulting from claims of negligence, errors, or omissions in professional work. Professionals in various industries, such as healthcare, law, consulting, and real estate, should seriously consider obtaining this coverage to mitigate potential risks.

By having professional liability insurance, professionals can focus on their work with peace of mind, knowing that they are protected from potential lawsuits and claims. It enhances their credibility and reputation, giving clients confidence in their services. On the other hand, not having this insurance exposes professionals to significant financial risks, reputational damage, and potential legal penalties.

When selecting a professional liability insurance policy, professionals should carefully assess their risks and coverage needs. They should compare policies and premiums from reputable insurance providers to ensure adequate coverage at a competitive price. By taking these steps and understanding the importance of professional liability insurance, professionals can protect themselves and their businesses from potential financial ruin and reputational harm.