Arizona Small Business Insurance

Arizona Small Business Insurance is a crucial aspect of running a business in The Grand Canyon State. It provides protection and peace of mind for entrepreneurs, safeguarding their assets and mitigating potential risks.

In a state known for its vibrant business environment, understanding the importance of AZ small business insurance is essential for long-term success.

Key Takeaways

- Small business insurance is crucial for protecting your business in Arizona.

- There are various types of insurance available, including general liability, property, workers’ compensation, business interruption, cyber liability, professional liability, and commercial auto insurance.

- Liability insurance can protect your business from lawsuits, while property insurance safeguards your assets.

- Workers’ compensation insurance ensures employee safety and protection, and business interruption insurance prepares for unexpected disruptions.

- Working with an experienced insurance agent can help you choose the right coverage for your AZ small business.

Understanding the Importance of Small Business Insurance in Arizona

Arizona is home to a diverse range of small businesses, from restaurants and retail stores to tech startups and professional services. Regardless of the industry, all small businesses face certain risks that can have significant financial consequences if not properly addressed. These risks include property damage, liability claims, employee injuries, cyber threats, and more.

Without adequate small business insurance coverage, entrepreneurs in Arizona expose themselves to potential lawsuits, financial losses, and even bankruptcy. In a litigious society like ours, it only takes one accident or lawsuit to jeopardize the future of a small business. Therefore, having comprehensive insurance coverage is not just a smart business decision but also a legal requirement in many cases.

Types of Small Business Insurance Available in Arizona

In Arizona, there are several types of small business insurance available to protect entrepreneurs from various risks. These include liability insurance, property insurance, workers’ compensation insurance, business interruption insurance, cyber liability insurance, professional liability insurance, and commercial auto insurance. See the Arizona Department of Insurance for more specific information.

Liability Insurance: Protecting Your Business from Lawsuits

| Topic | Description |

|---|---|

| Liability Insurance | A type of insurance that protects a business from financial loss due to claims of injury or damage caused by the business or its employees. |

| Types of Liability Insurance | General Liability Insurance, Professional Liability Insurance, Product Liability Insurance, Cyber Liability Insurance, Employment Practices Liability Insurance. |

| Benefits of Liability Insurance | Protects business assets, covers legal fees and settlements, provides peace of mind, helps maintain business reputation. |

| Factors Affecting Liability Insurance Cost | Type of business, location, size of business, claims history, coverage limits, deductible amount. |

| Liability Insurance Coverage Limits | The maximum amount an insurance company will pay for a covered claim. It is important to choose a coverage limit that adequately protects the business. |

| Liability Insurance Exclusions | Events or situations that are not covered by liability insurance, such as intentional acts, criminal activity, and certain types of lawsuits. |

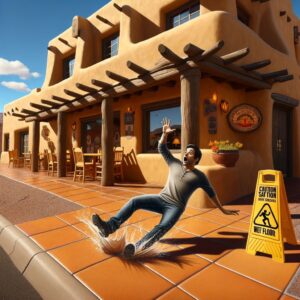

AZ Liability Insurance Claim

Liability insurance is one of the most important types of coverage for small businesses in Arizona. It protects entrepreneurs from legal claims arising from bodily injury or property damage caused by their products, services, or operations.

For example, if a customer slips and falls in your store and sues for medical expenses, liability insurance would cover the costs associated with the lawsuit.

Property Insurance: Safeguarding Your Business Assets

Property insurance is crucial for protecting your business assets in Arizona. It covers physical assets such as buildings, equipment, inventory, and furniture from damage or loss due to fire, theft, vandalism, or natural disasters. Without property insurance, a small business owner could face significant financial losses if their property is damaged or destroyed.

Workers’ Compensation Insurance: Ensuring Employee Safety and Protection

Workers’ compensation insurance is mandatory in Arizona for businesses with employees. It provides coverage for medical expenses and lost wages if an employee is injured or becomes ill on the job. This type of insurance not only protects employees but also shields employers from potential lawsuits related to workplace injuries.

Business Interruption Insurance: Preparing for Unexpected Disruptions

Business interruption insurance is designed to protect small businesses in Arizona from financial losses caused by unexpected disruptions such as natural disasters, fires, or other events that force the business to temporarily close. It covers lost income, ongoing expenses, and helps businesses get back on their feet after a significant interruption.

Cyber Liability Insurance: Protecting Your Business from Cyber Threats

In today’s digital age, cyber threats are a real concern for small businesses in Arizona. Cyber liability insurance provides coverage for losses resulting from data breaches, cyberattacks, and other cyber-related incidents. It helps cover the costs of notifying affected customers, legal fees, public relations efforts, and any financial losses incurred as a result of the breach.

Professional Liability Insurance: Covering Your Business from Professional Errors

Professional liability insurance, also known as errors and omissions insurance, is essential for businesses that provide professional services or advice in Arizona. It protects entrepreneurs from claims of negligence, errors, or omissions that result in financial losses for clients. This type of insurance is particularly important for professionals such as doctors, lawyers, consultants, and architects.

Commercial Auto Insurance: Protecting Your Business Vehicles

If your small business in Arizona relies on vehicles for operations, commercial auto insurance is a must-have. It provides coverage for vehicles used for business purposes, including liability protection for accidents, physical damage to the vehicles, and coverage for theft or vandalism. Commercial auto insurance ensures that your business is protected in the event of an accident or damage to your vehicles.

Choosing the Right Small Business Insurance Coverage for Your Arizona Business

When selecting small business insurance coverage in Arizona, there are several factors to consider. These include the nature of your business, the level of risk involved, your budget, and any legal requirements specific to your industry. It is crucial to assess your business’s unique needs and consult with an experienced insurance agent to determine the appropriate coverage.

Working with an Experienced Insurance Agent to Protect Your Arizona Small Business

Navigating the world of small business insurance can be complex, especially with the wide range of coverage options available in Arizona. Working with an experienced insurance agent who specializes in small business insurance can make all the difference. An agent can help assess your risks, recommend appropriate coverage, and ensure that you have the right protection for your specific business needs.

FAQs

Arizona Commercial Auto Insurance

What is small business insurance?

Small business insurance is a type of insurance policy that provides coverage for AZ businesses against losses due to events such as property damage, liability claims, and employee injuries.

Why do small businesses need insurance?

Small businesses need insurance to protect themselves from financial losses due to unexpected events such as accidents, natural disasters, and lawsuits. Insurance can help cover the costs of damages, legal fees, and medical expenses.

What types of small business insurance are available in Arizona?

There are several types of small business insurance available in Arizona, including general liability insurance, property insurance, workers’ compensation insurance, professional liability insurance, and cyber liability insurance.

What is general liability insurance?

General liability insurance provides coverage for AZ businesses against claims of bodily injury, property damage, and advertising injury. This type of insurance can help cover legal fees, medical expenses, and damages awarded in a lawsuit.

What is property insurance?

Property insurance provides coverage for businesses against damage or loss of property due to events such as fire, theft, or natural disasters. This type of insurance can help cover the costs of repairs or replacement of damaged property in Arizona.

What is workers’ compensation insurance?

Workers’ compensation insurance provides coverage for employees who are injured or become ill while on the job. This type of insurance can help cover medical expenses, lost wages, and rehabilitation costs of your AZ employees.

What is professional liability insurance?

Professional liability insurance provides coverage for Arizona small businesses against claims of negligence or errors and omissions in the services they provide. This type of insurance can help cover legal fees and damages awarded in a lawsuit.

What is cyber liability insurance?

Cyber liability insurance provides coverage for AZ businesses against losses due to cyber attacks, data breaches, and other cyber-related incidents. This type of insurance can help cover the costs of data recovery, legal fees, and damages awarded in a lawsuit.

Conclusion

In conclusion, small business insurance is a vital component of running a successful business in Arizona. It provides protection against various risks and ensures that entrepreneurs can focus on growing their businesses without worrying about potential financial losses.

By understanding the different types of insurance available and working with an experienced insurance agent, small business owners can safeguard their assets and protect their businesses from unforeseen circumstances. Don’t wait until it’s too late – take action now and secure the right insurance coverage for your Arizona small business.