Business Interruption Insurance, also known as Business Income Insurance, is a type of insurance coverage that helps protect businesses from financial losses incurred due to unexpected disruptions that interrupt normal business operations. Here’s an overview of key aspects related to Business Interruption Insurance:

Purpose and Coverage:

- Purpose: Designed to compensate businesses for the income they would have earned if their operations had not been interrupted.

- Coverage: Typically covers loss of income, fixed costs, and expenses during the period of interruption.

Triggers for Coverage:

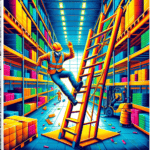

- Physical Damage: Often triggered by physical damage to the insured property, such as from fire, flood, or other covered perils.

- Non-Physical Damage (Contingent Business Interruption): Extends coverage to disruptions caused by events at the premises of suppliers, customers, or other key business partners.

Key Components:

- Net Income Coverage: Replaces the income lost during the interruption period. Continuing Expenses

- Coverage: Covers ongoing expenses, such as rent, utilities, and certain employee wages.

- Extra Expense Coverage: Reimburses additional costs incurred to resume operations quickly, such as temporary relocation or expedited equipment purchases.

Waiting Period:

- Business Interruption Insurance often includes a waiting period before coverage kicks in. This period allows for the assessment of the extent of the interruption.

Business Income Calculation:

- The calculation of business income is typically based on historical financial records, and projections may be used for businesses with seasonal variations.

Extensions and Endorsements:

- Businesses can enhance coverage by adding endorsements or extensions, such as coverage for civil authority orders, service interruption, or ingress/egress issues.

Importance for Small and Large Businesses:

- Small businesses with limited financial reserves and large enterprises heavily dependent on continuous operations can benefit significantly from Business Interruption Insurance.

Risk Assessment:

- Businesses should conduct a thorough risk assessment to determine potential threats to continuity, including natural disasters, equipment breakdowns, and supply chain disruptions.

Policy Exclusions:

- It’s essential for businesses to be aware of policy exclusions, such as those related to pandemics, certain types of perils, or inadequate documentation of losses.

Claims Process:

- In the event of an interruption, businesses need to document and report losses promptly to their insurance provider. A detailed and accurate record of financial losses is crucial for the claims process.