Product Liability Insurance

Product liability insurance is a crucial aspect of risk management for businesses. It provides coverage for claims arising from the use of a company’s products, protecting against potential legal and financial consequences.

In today’s litigious society, where consumers are increasingly aware of their rights and product safety standards are stringent, having product liability insurance is more important than ever.

Product liability insurance is a type of coverage that protects businesses from claims related to the products they manufacture, distribute, or sell. It provides financial protection in the event that a product causes harm or injury to a consumer. This insurance typically covers legal fees, settlements, and judgments associated with product liability claims.

The way product liability insurance works is that businesses pay premiums to an insurance provider in exchange for coverage. The premiums are based on factors such as the type of products being sold, the size of the business, and its claims history.

In the event of a claim, the insurance provider will investigate the incident and provide legal representation if necessary. If the claim is found to be valid, the insurance company will cover the costs up to the policy’s limits.

Key Takeaways

- Product liability insurance protects your business from claims related to the products you sell.

- Without product liability your business could face financial ruin from a single claim.

- There are different types of product liability claims, including design defects, manufacturing defects, and failure to warn.

- The responsibility for product liability claims can fall on manufacturers, distributors, and retailers.

- When choosing a policy, consider factors such as coverage limits, deductibles, and exclusions.

Why Your Business Needs Product Liability Insurance

Not having product liability insurance can expose your business to significant risks. Without this coverage, you may be personally liable for any damages or injuries caused by your products. This can result in substantial financial losses and even bankruptcy for your business.

In addition to the financial consequences, product liability claims can also damage your business’s reputation. Negative publicity surrounding a defective product can lead to a loss of customer trust and loyalty. This can have long-lasting effects on your bottom line and future sales.

Types of Product Liability Claims

| Types of Product Liability Claims | Description |

|---|---|

| Design Defects | Claims that the product was inherently dangerous due to a flaw in its design. |

| Manufacturing Defects | Claims that the product was dangerous due to an error in the manufacturing process. |

| Marketing Defects | Claims that the product was marketed in a way that failed to warn consumers of its potential dangers. |

| Breach of Warranty | Claims that the product did not meet the promises made by the manufacturer or seller. |

Types of Product Liability Claims

Product liability claims can arise from various defects in a product’s manufacturing, design, or marketing. Understanding these different types of claims is essential for businesses to mitigate their risks effectively.

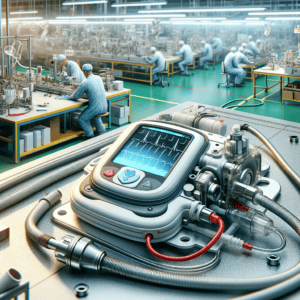

Manufacturing defects occur when there is an error or flaw in the production process that makes a product unsafe for its intended use. These defects can range from faulty components to improper assembly. If a consumer is injured as a result of a manufacturing defect, they may file a product liability claim against the manufacturer.

Design defects, on the other hand, occur when there is an inherent flaw in the product’s design that makes it unreasonably dangerous.

Unlike manufacturing defects, design defects affect an entire line of products rather than just a single unit. If a consumer is harmed due to a design defect, they may hold the manufacturer responsible for their injuries.

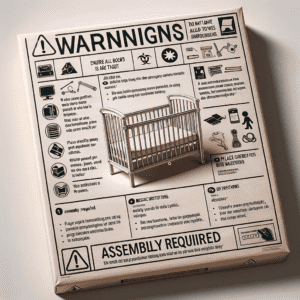

Marketing defects refer to failures in providing adequate warnings or instructions for the safe use of a product. If a product does not have proper labeling or fails to warn consumers about potential risks, the manufacturer may be held liable for any resulting injuries.

Who is Responsible for Product Liability Claims?

Product liability claims can be filed against various parties involved in the supply chain, including manufacturers, distributors, and retailers. The specific responsibilities and liabilities of each party may vary depending on the jurisdiction and the circumstances of the case.

Manufacturers are typically held to the highest standard of liability. They have a duty to ensure that their products are safe for consumers and free from defects. If a product causes harm due to a defect, the manufacturer may be held strictly liable for any resulting injuries.

Distributors, on the other hand, are responsible for ensuring that the products they distribute are safe and meet all applicable safety standards. While they may not be directly involved in the manufacturing process, they can still be held liable if they knew or should have known about a product’s defect and failed to take appropriate action.

Retailers also have a duty to sell safe products to consumers. If they sell a defective product and it causes harm, they may be held liable for any resulting injuries. However, retailers may have certain defenses available to them, such as claiming that they did not have the opportunity to inspect the product for defects.

How to Choose the Right Policy

Choosing the right product liability insurance policy is crucial for businesses to ensure they have adequate coverage. There are several factors to consider when selecting a policy, including coverage options, limits, and deductibles.

Coverage options can vary depending on the insurance provider and the specific needs of your business. It is important to carefully review the policy to ensure that it covers all potential risks associated with your products. Some policies may offer additional coverage for things like product recalls or reputational damage.

Coverage limits refer to the maximum amount that the insurance company will pay out in the event of a claim. It is essential to choose coverage limits that adequately protect your business’s assets and potential liabilities. Underinsuring can leave your business vulnerable to significant financial losses.

Deductibles are the amount that you, as the insured, must pay out of pocket before the insurance coverage kicks in. Higher deductibles can lower your premium costs but may also increase your financial responsibility in the event of a claim. It is important to carefully consider your business’s financial situation and risk tolerance when choosing a deductible.

Factors that Affect Product Liability Premiums

Factors that Affect Product Liability Premiums

Several factors can influence the cost of product liability insurance premiums. Insurance providers take into account various risk factors when determining premiums, including industry type, business size, and claims history.

The industry type plays a significant role in determining premiums because certain industries may have a higher risk of product liability claims. For example, businesses involved in manufacturing medical devices or pharmaceuticals may face higher premiums due to the potential for severe injuries or fatalities.

Business size is another factor that insurers consider when determining premiums. Larger businesses may have higher premiums due to their increased exposure to potential claims. This is because larger businesses typically produce and distribute more products, increasing the likelihood of defects or injuries.

Claims history is also a crucial factor in determining premiums. If a business has a history of product liability claims, insurance providers may view them as a higher risk and charge higher premiums. On the other hand, businesses with a clean claims history may be eligible for lower premiums.

Common Exclusions

While product liability insurance provides valuable coverage, it is important to be aware of common exclusions that may limit or exclude coverage for certain situations. Understanding these exclusions can help businesses manage their risks effectively and take appropriate measures to mitigate potential liabilities.

Intentional acts are typically excluded from product liability insurance coverage. This means that if a business intentionally causes harm or injury through its products, the insurance policy will not provide coverage. It is essential for businesses to prioritize product safety and avoid any intentional acts that could harm consumers.

Punitive damages are another common exclusion in product liability insurance policies. Punitive damages are awarded to punish the defendant for their actions and deter others from engaging in similar behavior. Since punitive damages are meant to punish, rather than compensate, they are often excluded from coverage.

Contractual liability is also commonly excluded from product liability insurance policies. This means that if a business assumes liability for damages or injuries through a contract, the insurance policy will not cover those liabilities. It is important for businesses to carefully review their contracts and understand the potential liabilities they may be assuming.

Steps to Take in the Event of a Product Liability Claim

In the event of a product liability claim, it is crucial for businesses to take immediate action to protect their interests and mitigate potential damages. By following these steps, businesses can ensure that they are properly handling the claim and cooperating with their insurance provider.

The first step is to notify your insurance provider as soon as possible after becoming aware of the claim. Prompt notification allows the insurance company to begin investigating the incident and providing legal representation if necessary. Failure to notify the insurance provider in a timely manner may result in a denial of coverage.

Documenting the incident is also essential. This includes gathering all relevant information, such as photographs, witness statements, and any other evidence related to the claim. Thorough documentation can help support your case and provide evidence of any defects or negligence that may have caused the injury.

Cooperating with the investigation is crucial for businesses to demonstrate their commitment to resolving the claim. This includes providing any requested information or documentation to the insurance company and cooperating with their appointed legal counsel. Failure to cooperate may result in a denial of coverage or a reduction in the amount of coverage provided.

How to Mitigate Product Liability Risks

How to Mitigate Product Liability Risks

While product liability insurance provides valuable protection, businesses should also take proactive measures to mitigate their product liability risks. By implementing quality control measures, proper labeling and warnings, and regular product testing, businesses can reduce the likelihood of defects and injuries.

Quality control measures are essential for ensuring that products meet safety standards and are free from defects. This includes implementing rigorous testing procedures throughout the manufacturing process, as well as conducting regular inspections and audits. By maintaining high-quality standards, businesses can minimize the risk of defective products reaching consumers.

Proper labeling and warnings are crucial for informing consumers about potential risks associated with a product. Clear and concise instructions should be provided to ensure safe use, and any potential hazards should be clearly communicated through warning labels. By providing adequate warnings and instructions, businesses can reduce the risk of injuries caused by improper use or lack of awareness.

Regular product testing is another important aspect of mitigating product liability risks. By conducting thorough testing at various stages of the manufacturing process, businesses can identify and address any potential defects or safety issues before products reach consumers. Regular testing helps ensure that products meet all applicable safety standards and regulations.

Product Liability vs. General Liability Insurance

While general liability insurance provides coverage for a wide range of risks, it may not provide adequate protection for product liability claims. Product liability insurance is specifically designed to cover claims arising from the use of a company’s products, providing more comprehensive coverage for businesses in this regard.

General liability insurance typically covers claims related to bodily injury, property damage, and personal injury. While it may provide some coverage for product liability claims, it may have limitations or exclusions that could leave businesses exposed to significant risks. Product liability insurance, on the other hand, is specifically tailored to cover the unique risks associated with manufacturing, distributing, or selling products.

It is important for businesses to have both product liability insurance and general liability insurance to ensure comprehensive coverage. By having both types of insurance, businesses can protect themselves against a wide range of risks and potential liabilities.

Finding the Right Insurance Provider

Finding the right product liability insurance provider is crucial for businesses to ensure they have reliable coverage and support. When researching and comparing providers, there are several factors to consider to make an informed decision.

One important factor is the provider’s reputation and financial stability. It is essential to choose an insurance company with a strong track record of reliability and financial strength. This ensures that they will be able to fulfill their obligations in the event of a claim.

Customer service and support are also important considerations. A responsive and knowledgeable insurance provider can make a significant difference in the claims process. It is important to evaluate their customer service reputation and their ability to provide timely assistance when needed.

Additionally, it is beneficial to seek recommendations from other businesses in your industry or consult with an insurance broker who specializes in product liability insurance. They can provide valuable insights and help you navigate the complex process of selecting the right provider and policy for your business.

FAQs

What is product liability insurance?

Product liability insurance is a type of insurance that protects businesses from financial losses due to legal claims arising from the use of their products. It covers the costs of legal defense, settlements, and judgments.

Why do businesses need product liability insurance?

Businesses need product liability insurance to protect themselves from financial losses due to legal claims arising from the use of their products. Without this insurance, businesses may have to pay for legal defense, settlements, and judgments out of their own pockets, which can be very expensive.

What does product liability insurance cover?

Product liability insurance covers the costs of legal defense, settlements, and judgments arising from legal claims related to the use of a business’s products. It may also cover the costs of product recalls and other related expenses.

What types of businesses need product liability insurance?

Any business that manufactures, distributes, or sells products should consider getting product liability insurance. This includes businesses in industries such as manufacturing, retail, and food service.

How much does product liability insurance cost?

The cost of product liability insurance varies depending on a number of factors, including the type of products being sold, the size of the business, and the level of coverage needed. Businesses should consult with an insurance agent to get a quote for their specific needs.

What should businesses look for when choosing a product liability insurance policy?

When choosing a product liability insurance policy, businesses should look for a policy that provides adequate coverage for their specific needs. They should also consider the reputation and financial stability of the insurance company, as well as any exclusions or limitations in the policy.

Conclusion

Product liability insurance is an essential component of risk management for businesses involved in manufacturing, distributing, or selling products. It provides coverage for claims arising from product defects or injuries, protecting businesses from potential legal and financial consequences. By understanding the importance of product liability insurance, businesses can take proactive steps to protect their interests and ensure the safety of their customers. It is crucial to choose the right insurance policy and provider, as well as implement effective risk mitigation strategies, to safeguard your business’s reputation and financial stability. Taking action now to secure product liability insurance is a wise investment in the long-term success and sustainability of your business.