Workers Compensation Insurance – An Employers Guide

Workers Compensation Insurance is a type of insurance that provides benefits to employees who suffer work-related injuries or illnesses.

It is designed to protect both employers and employees by providing financial support and medical treatment in the event of an accident or illness that occurs on the job.

This insurance is crucial for employers as it helps them fulfill their legal obligations, protect their business from lawsuits, and ensure the well-being of their employees.

Legal Requirements for Employers

In most states, employers are legally required to have workers compensation insurance. The specific laws and regulations regarding workers compensation vary from state to state, but the general requirement is that employers must provide coverage for their employees. Failure to comply with these laws can result in severe penalties, including fines, legal action, and even imprisonment.

Benefits of Workers Comp for Employers

One of the main benefits of workers compensation insurance for employers is protection against lawsuits and legal fees. If an employee is injured on the job, they have the right to sue their employer for damages. Workers compensation insurance provides coverage for these types of claims, saving employers from potentially costly legal battles.

Another benefit is cost savings on medical expenses and lost wages. When an employee is injured or becomes ill due to work-related activities, workers compensation insurance covers their medical treatment and provides wage replacement while they are unable to work. This can help alleviate the financial burden on both the employee and the employer.

Furthermore, workers compensation insurance can improve employee morale and retention. Knowing that they are protected in case of an accident or illness can give employees peace of mind and make them feel valued by their employer. This can lead to increased job satisfaction, loyalty, and productivity.

Benefits of Workers Compensation for Employees

Workers compensation insurance provides several benefits for employees as well. One of the main benefits is guaranteed medical treatment and wage replacement. If an employee is injured on the job, they can receive the necessary medical care without having to worry about the cost. Additionally, workers compensation insurance provides wage replacement while the employee is unable to work, ensuring that they can still support themselves and their families during their recovery.

Another benefit is protection against financial hardship. Work-related injuries or illnesses can result in significant medical expenses and lost wages. Workers compensation insurance helps alleviate these financial burdens by covering medical costs and providing wage replacement, reducing the financial strain on the employee and their family.

Furthermore, workers compensation insurance provides peace of mind for employees and their families. Knowing that they are protected in case of an accident or illness can provide a sense of security and reduce anxiety. This can help employees focus on their recovery and return to work more quickly.

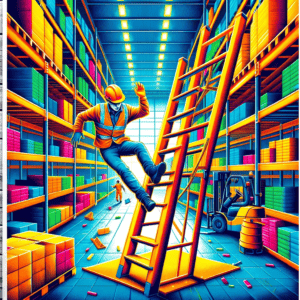

Types of Injuries Covered by Workman’s Compensation

Workers comp covers a wide range of injuries and illnesses that occur in the workplace. This includes physical injuries such as broken bones, sprains, and strains, as well as more serious injuries such as traumatic brain injuries or spinal cord injuries. It also covers occupational illnesses that develop over time due to exposure to hazardous substances or repetitive motions, such as respiratory diseases or carpal tunnel syndrome.

Additionally, workers compensation insurance may cover mental health conditions that are caused or aggravated by work-related stress, such as anxiety or depression.

How Workers Comp Insurance Works

Accident Injury Claim Compensation

When an employee is injured or becomes ill due to work-related activities, they must file a workers compensation claim to receive benefits.

The process for filing a claim may vary depending on the state and the insurance company, but generally involves notifying the employer, seeking medical treatment, and completing the necessary paperwork.

To determine eligibility for benefits, the insurance company will review the claim and assess whether the injury or illness is work-related. They may request additional information or conduct an investigation if there are any doubts about the validity of the claim.

Once eligibility is established, the insurance company will provide the necessary benefits, such as medical treatment and wage replacement.

Employers play a crucial role in the workers compensation process. They are responsible for providing the necessary information and documentation to the insurance company, cooperating with any investigations, and ensuring that the employee receives the appropriate medical treatment and support.

How to Choose the Right Policy

When selecting a workers comp policy, there are several factors to consider. These include the size and nature of the business, the number of employees, the industry, and the state requirements. It is important to choose a policy that provides adequate coverage for potential risks and meets the legal requirements.

Comparing different policy options is also essential. This includes reviewing the coverage limits, deductibles, premiums, and any additional benefits or services offered by the insurance company. Working with an insurance agent or broker can be helpful in navigating the options and finding the best policy for your specific needs.

How to File a Workers Comp Claim

filling up a work injury claim form

Filing a workers compensation claim involves several steps. First, the employee must notify their employer of the injury or illness as soon as possible.

This should be done in writing and include details of how and when the injury occurred. The employer will then provide the necessary forms and instructions for filing a claim.

The employee should seek medical treatment for their injury or illness and inform their healthcare provider that it is work-related. The healthcare provider will document the diagnosis, treatment plan, and any work restrictions or limitations.

The employee must then complete the necessary paperwork for filing a claim, which typically includes a claim form provided by the employer or insurance company. This form should be filled out accurately and include all relevant information about the injury or illness.

It is important to avoid common mistakes when filing a workers compensation claim, such as providing incomplete or inaccurate information, missing deadlines, or failing to follow up on the claim. These mistakes can delay or jeopardize the benefits, so it is crucial to carefully follow the instructions and seek assistance if needed.

Common Workers Compensation Insurance Myths Debunked

There are several common myths and misconceptions about workers comp that need to be debunked. One myth is that workers compensation insurance is too expensive for small businesses. While the cost of insurance premiums can vary depending on the size and nature of the business, there are options available that can fit within a small business’s budget. Additionally, the potential costs of not having workers compensation insurance, such as legal fees and penalties, can far outweigh the cost of the insurance itself.

Another myth is that employees can sue their employer even with workers compensation insurance. In most cases, workers compensation insurance provides exclusive remedy for work-related injuries or illnesses, meaning that employees cannot sue their employer for damages. However, there are exceptions to this rule, such as cases of intentional harm or gross negligence by the employer.

A third myth is that only high-risk industries need workers comp insurance. While certain industries may have a higher risk of work-related injuries or illnesses, accidents can happen in any workplace. It is important for all employers to have workers compensation insurance to protect their employees and their business.

Consequences of Not Having Workers Compensation Insurance

Penalty For Not Having Workers Comp

Not having workers compensation insurance can have severe legal and financial consequences for employers. If an employee is injured on the job and the employer does not have insurance, they may be held personally liable for medical expenses, lost wages, and other damages. This can result in significant financial hardship and potentially bankrupt the business.

Furthermore, not having workers compensation insurance can have a negative impact on employees and their families. Without coverage, injured or ill employees may struggle to receive the necessary medical treatment and support, leading to prolonged recovery times and increased financial strain.

Additionally, not having workers compensation insurance can damage a business’s reputation and hinder its operations. Potential employees may be hesitant to work for a company that does not prioritize their safety and well-being, and customers may lose trust in a business that does not have proper insurance coverage.

Certain States Have Grave Consequences For Not Providing Workers Comp

The penalty for not having workers compensation insurance varies by state. It can result in a fine, jail time, or even both. The states with most severe penalties include:

- California: In California, it is a criminal offense to not provide workers’ compensation for your employees. It’s punishable by up to a year in jail and a fine of no less than $10,000 – or both. Illegally uninsured employers could face a penalty of up to $100,000.

- Illinois: An employer who did not provide workers’ comp when it was required must pay $500 for each day of noncompliance, with a minimum fine of $10,000.

- New York: Illegally uninsured employers could be charged with a misdemeanor or a felony. Fines range from $1,000 to $50,000, in addition to a penalty of $2,000 for every 10 days without coverage.

- Pennsylvania: In Pennsylvania, intentional noncompliance is a felony of the third degree. It can result in a fine of $15,000 and up to seven years in jail.

Conclusion and Final Thoughts on Workers Compensation Insurance

Workers comp is a crucial investment for employers to protect their business, fulfill their legal obligations, and ensure the well-being of their employees. It provides benefits for both employers and employees, including protection against lawsuits, cost savings on medical expenses and lost wages, improved employee morale and retention, guaranteed medical treatment and wage replacement for employees, protection against financial hardship, and peace of mind for employees and their families.

It is important for employers to understand the legal requirements for workers compensation insurance in their state and to choose the right policy that provides adequate coverage. Filing a workers compensation claim correctly and in a timely manner is essential to ensure that employees receive the benefits they are entitled to. Debunking common myths about workers compensation insurance is also important to dispel misconceptions and encourage employers to prioritize the safety and well-being of their employees.

Ultimately, investing in workers compensation insurance is not only a legal requirement but also a moral obligation. By providing a safe and supportive work environment, employers can protect their employees, their business, and their reputation.